MLR Compliance

Introduction

Medical loss ratio (MLR) gauges the percentage of enrollee premiums utilized by health insurance companies for medical claims, contrasting with non-claims expenses like administration or profits. States, acting as the principal regulators of health insurance, often establish their own MLR requirements to assess companies and compare health plans.

In general, the higher the MLR, the more value a consumer receives for each dollar of paid premium. For example, an 85% MLR means that 85% of premium dollars paid into a plan are paid out in the form of benefits.

The MLR is an aggregate measure. Because the ratio is based on a health plan’s overall performance, some enrollees may pay more in premiums during a year than they receive in benefits, while others may receive benefits that far exceed their premium payments.

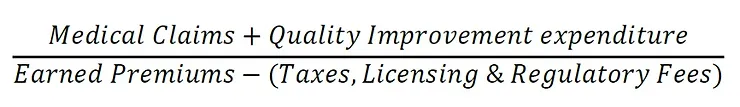

In its simplest form, the federal MLR formula is:

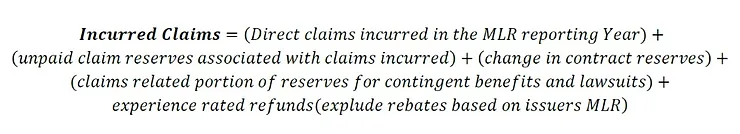

Where;

Medicaid MLR Standards – 42 CFR 438.8

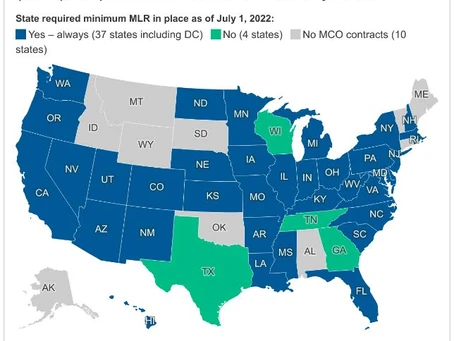

In Medicaid managed care contracts that started on or after July 1, 2017, states are required to include contract requirements for managed care plans to calculate and report an MLR.

The 2016 Final Rule included various MLR-related standards in the actuarial soundness requirements in 42 CFR 438.4 and 438.5; added new minimum standards for the calculation and reporting of an MLR applicable to Medicaid managed care contracts at 42 CFR 438.8; and added requirements for state oversight of MLR reporting at 42 CFR 438.74.

In addition, the 2016 Final Rule, 42 CFR 457.1203, incorporated these MLR standards into the CHIP requirements for managed care plans. 81 FR 27758-59. The provisions require that an MLR be calculated, reported, and used in the Medicaid and CHIP managed care rate setting context by establishing, respectively, the substantive standards for how an MLR is calculated and reported by MCOs, PIHPs, and PAHPs (referred to as managed care plans), and state responsibilities in oversight of the MLR standards.

For rating periods starting on or after July 1, 2017, states are required to include the following requirements in their Medicaid managed care plan contracts:

1. Calculate and report an MLR in accordance with the standards laid out in 42 CFR 438.8; and

2. Submit to the state an annual MLR report, as required in 42 CFR 438.8(k), that includes the calculated MLR, the underlying data components and methodologies for allocating expenditures, any remittance owed to the state if applicable, a comparison of the information reported with the audited financial report required under 42 CFR 438.3(m), a description of the aggregation method used under 42 CFR 438.8(i), and the number of member months for each MLR reporting year.

Managed care plans are required to submit the annual report in the time and manner established by the state, which must be within 12 months after the end of the MLR reporting year.

In accordance with 42 CFR 438.74(a), states are required to annually submit to CMS a summary description of the MLR report(s) received from the managed care plans. This summary description must be submitted with the related rate certifications under 42 CFR 438.7. In addition, this summary description must include at least: the amount of the numerator, the amount of the denominator, the MLR percentage achieved, the number of member months, and if applicable any remittances owed by each managed care plan for that MLR reporting year.

For contract rating periods beginning on or after July 1, 2019, for Medicaid managed care contracts, capitation rates must be developed in such a way that the managed care plan would reasonably achieve a medical loss ratio standard of at least 85 percent for the rate year, following the method laid out in 42 CFR 438.8. This is required as part of the actuarial soundness requirements under 42 CFR 438.4(b)(9). States must also consider the managed care plan’s past MLR, as calculated under 42 CFR 438.8, in the development of the capitation rates consistent with 42 CFR 438.5(b)(5).

New York State Medicaid MLR Requirements

New York State Medicaid MLR Requirements

In New York State, the Department of Health (DOH) to ensures that each Managed Care Organization (MCO) calculates and reports a MLR in accordance with 42 CFR Part 438. The DOH has elected to set the minimum MLR percentage at 86%, except for HARP which is set at 89%. The MLR Reporting Period is aligned with the rating period for each line of business (42 CFR §438.8(b)).

Per 42 CFR 438.8(j), New York State has implemented a MLR remittance collection should the Managed Care Organization (MCO) MLR result fall below the minimum percentage target and deemed credible (fully or partially) for the rating period for each line of business (LOB).

The rating period for NYS is on a state fiscal year (SFY) of 4/1-3/31 for Medicaid, HIV SNP, HARP, MLTC Partial, MAP, FIDA, and PACE lines of business.

CMS includes a credibility adjustment if applicable for the MLR calculation when a MCO is subject to a MLR remittance. The MCOs individual MLR percentages include applicable credibility adjustments if deemed partially credible based on member months in the MLR reporting period.

Additional Requirements for 2023 – 2024 Reporting Period

DOH sends Managed Care MLR instructions and statewide templates to be filled before state fiscal year end. For 31st March 2024 fiscal year end, DOH has received guidance from CMS that plans should include both the Medicare and Medicaid experience in their MLR calculation for the Medicaid/Medicare integrated lines of business. Thus, DOH has included a separate Line 4.9 in the template that identifies the Medicare Capitation Payments for lines of business with dually eligible members such as Medicaid Managed Care, HARP, MAP, PACE and FIDA IDD. The remittance for plans with dually eligible lines of business will be based on the Medicaid premium ONLY excluding Medicare Capitation Line 4.9.

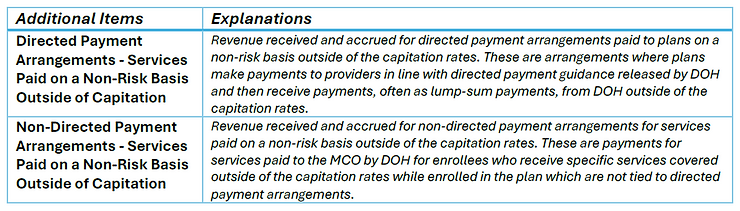

Additional items 4.11 and 4.12 were also added to be included in the premium revenue under denominator. Delineation of the same is given below.

Connect with us at Lepton Actuarial & Consulting, LLC to explore how we can assist you with your specific needs. We’re here to provide expert guidance and support tailored to your unique requirements. Reach out to us today to start the conversation!